01.12.2024

Special Report

Des idées radicales : une vision de l’impôt par Proudhon

Pierre-Joseph Proudhon was a central figure in 19th-century fiscal and societal affairs, advocating a new way of organizing society. He is recognized as one of the first anarchist theorists.

Immersion in the theorist's world

Born in Besançon on January 15th 1809, Pierre-Joseph Proudhon came from a modest family. His father was a cooper and his mother a cook, deeply rooted in the reality of the working classes. After completing his elementary education, the young Proudhon was awarded a scholarship to continue his studies at the Collège Royal de Besançon, where he distinguished himself by his intelligence and keen interest in literature, but where he also experienced considerable financial difficulties. As a result, he was forced to abandon his studies at the age of 19 to work as a typographer, a job that gave him access to many philosophical and economic works. It was in this context that he began to form his vision of society, radically opposed to those in place in Europe during the Restoration era. The new political current with which the young author began to identify was none other than anarchism.

Pierre-Joseph Proudhon

Pierre-Joseph Proudhon

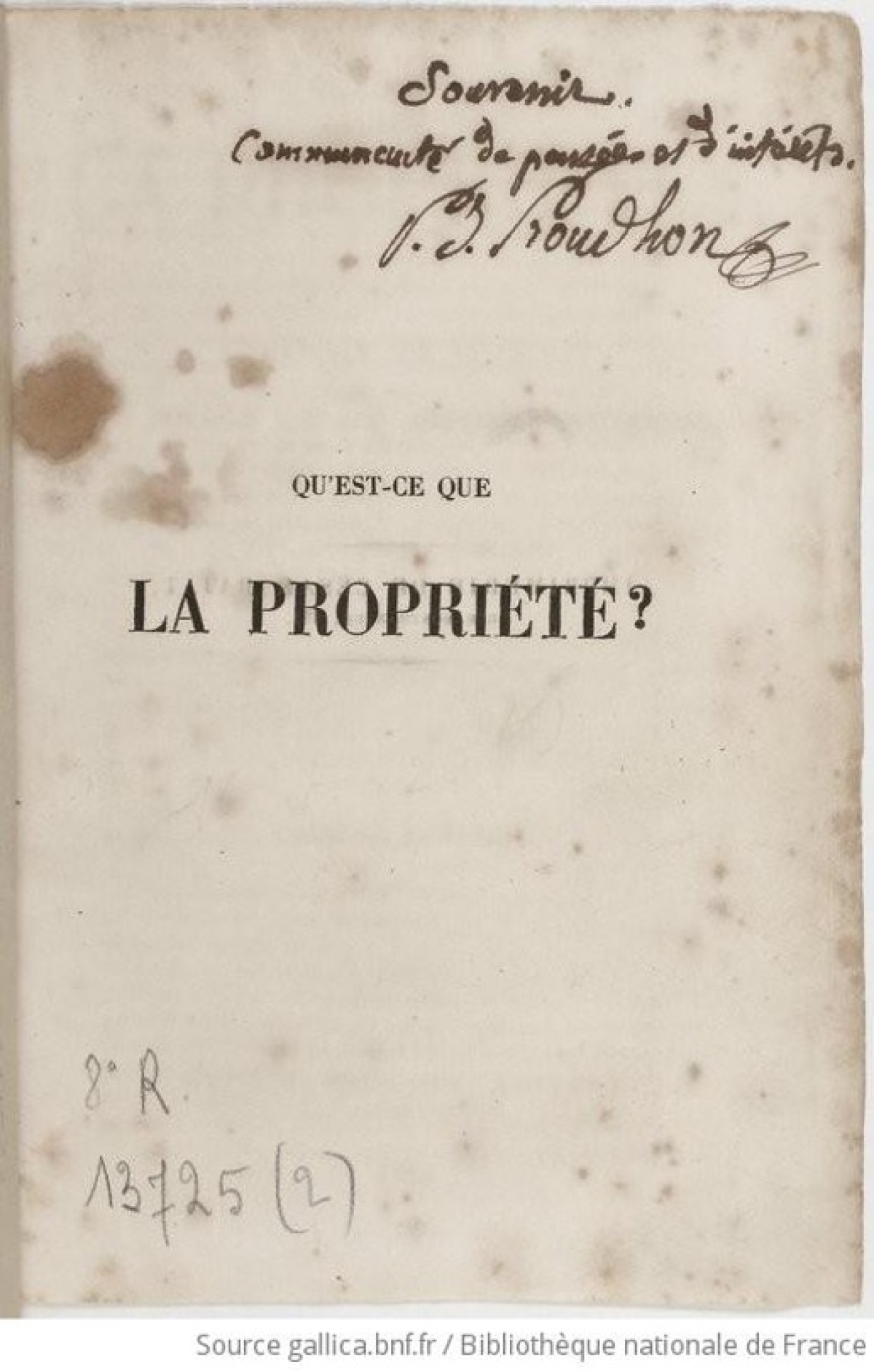

The author's first anarchist ideas were expressed in “What is property?” (1840), where he developed his famous formula “property is theft”, which in itself sums up Proudhon's overall thinking. In it, he criticizes private property as a source of social injustice, believing that it allows a minority to monopolize resources to the detriment of the toiling majority. The book went on to become a controversial and influential figure on the French political scene. In his reflections, Proudhon proposed alternatives to counter this “domination”, with the introduction of a system based on self-management and cooperation between workers, for example.

Cover of “Qu'est-ce que la propriété” (1840) by Proudhon

Cover of “Qu'est-ce que la propriété” (1840) by Proudhon

During the 1848 revolution in France, Proudhon embraced republican and socialist ideas, for which he became an outspoken spokesman. Elected to the Constituent Assembly following the overthrow of the July Monarchy, he criticized the Ancien Régime and called for a radical overhaul of society, at a time when the establishment of the Second Republic encouraged the emergence of new ideologies and societal doctrines.

Our philosopher du jour is thus opposed to monarchy and its institutions, represented by the Church among others and symbolizing a spiritual power over the masses. The time has come for him to do away with it, as illustrated in this passage: “Any royalty that allows itself to be circumscribed will end in demagogy; any divinity that defines itself resolves itself into a pandemonium. Christolatry is the final stage in this long evolution of human thought. Angels, saints and virgins reign in heaven with God, says the catechism; demons and the reprobate live in the underworld of eternal torment. Ultramundane society has its left and its right: it's time for the equation to come to an end, for this mystical hierarchy to descend to earth and show itself in all its reality”.

It is important to understand this anti-conformism and the author's need for novelty, in order to fully comprehend Proudhon's economic vision and hence the role of taxation in society.

The turbulent period around 1848 saw the birth of several works dealing with the role of taxation in society. These included the “Système des contradictions économiques ou Philosophie de la misère” (1846) and the “Théorie de l'Impôt” (1861), which Proudhon wrote at the same time as Walras at the 1861 international tax congress in Lausanne, discussed in the previous article.

Taxes as an instrument of injustice

Proudhon considered that taxation, in its modern form, prejudices society by the burden it places on citizens. It finances civil servants who bring no added value to society and do not improve living standards. This is explained in the text as follows: “The state, the police, or their means of existence, the tax, is, I repeat, the official name of the class that is designated in political economy under the name of the unproductive, in a word of social domesticity”.

According to the author, “All taxes fall into two main categories: 1º taxes of apportionment, or privilege: these are the oldest established”. They include property taxes, for example. The role of the second category, “consumption taxes [...] is to equalize public burdens among all, by assimilating the former”. This type of tax is the forerunner of the VAT, and is theoretically designed to spread the burden of taxation more evenly by taxing the basic necessities that society as a whole needs.

However, following this description, Proudhon noted that universal and equal taxation between citizens as defined above was profoundly unjust, as it weighed disproportionately on the working classes: “The tax, while purporting to be proportional, is in reality regressive, hitting small fortunes harder than large ones”. He notes that “far from being a redistribution mechanism, taxation serves to perpetuate social inequalities”. For him, this situation is the result of a dysfunction in the system, which instead of correcting social inequalities, reinforces them by taxing the most vulnerable citizens in the same way as the wealthy (with income tax, for example), leading the former to bear a heavier burden than the better-off. This aspect of Proudhon's reasoning is similar to that evoked by Walras. However, we note that the writers differ on how to solve this problem.

Proposals for tax reform

To remedy this injustice, Proudhon proposes several measures in his “Théorie des Impôts”. Firstly, and as already stated, equality of contributions is to be achieved through a more equitable distribution of the State's tax burden, taking into account each citizen's real capacity to pay, which is not the case at present.

Secondly, the tax system must be reformed to make it less opaque and more transparent to the public. Every taxpayer should be able to understand exactly what they are paying and why. What's more, the people must be given greater control over how these funds are actually used. The idea of decentralized fee collection is also raised in this context.

Thirdly, and although not explicitly called for by Proudhon, a progressive tax should be implemented so that the rich pay a greater percentage of their income than the poor.

Finally, the state should reduce its spending to the bare essentials, so that public money is used to benefit the people directly (and not to pay civil servants, as already seen above).

Cartoon on a French tax (1900)

Comparison with the vision of Léon Walras

Léon Walras, while sharing certain points of convergence with Proudhon in his criticism of the tax system of his time, takes a very different approach to his thinking on taxation. In his “Théorie critique de l'impôt” (1861), Walras approaches the question from a more technical and economic angle, focusing on market efficiency and the rationalization of the tax system. He rejects the simplistic proposals for a single tax on capital or income, supported by contemporaries such as Joseph Garnier and Émile de Girardin. For Walras, taxation should be designed to minimize economic distortions, while ensuring that all citizens contribute their fair share. He thus proposed a combination of a wealth tax and an income tax, in order to distribute the tax burden more fairly, as mentioned in the previous article on Walras' vision.

In contrast to Proudhon, whose critique of taxation was based primarily on considerations of social justice, Walras was more interested in the economic impact of taxes on society. For him, it is above all a problem of economic equilibrium, as Walras cites in his “Critical Theory of Taxation”: “Taxation should not only serve to redistribute wealth, but also to guarantee the stability of the market”. So, while Proudhon sees taxation as a tool for redistribution to correct the inequalities inherent in capitalism, Walras sees it as a mechanism for improving the efficiency of the economic system without upsetting the foundations of the social order.

The mathematical approach is therefore important in this context. Proudhon included it less in his reflections, proposing only theoretical ideas on how to reform taxation. Indeed, he was totally opposed to the capital tax proposed by Walras, as “the idea of taxing capital is contrary to the very principle of taxation. Tax is the expression of an exchange between the citizen and the State. It is the price paid by the former to the latter, for the share of the service he derives from it, a service which is naturally proportionate to capital, but the price of which is paid by the product”. What's more, “the tax on capital will thus be, no more and no less than before, a tax on land, a land tax; a tax on instruments of labor, currently a patents tax, a rental contribution, a consumption tax, etc. The only difference will be that, instead of a tax on capital, a tax on instruments of labor will be a tax on land. All the difference will be that, instead of these different taxations of name, determination, base and distribution, all the varieties of capital will be reduced to a common expression, i.e. to a valuation in cash, according to which the contribution will be imposed”.

Philosophical and economic differences

The differences between Proudhon and Walras are not limited to their visions of taxation; they are rooted in their opposing philosophical conceptions. Proudhon, as an anarchist thinker, defends a radically anti-statist vision, in which central power is seen as an oppressive force, responsible for the reproduction of inequalities. He proposes decentralized management mechanisms and advocates a society based on the autonomy of local communities and individuals. This perspective is reflected in his vision of taxation, which he wishes to transform into an instrument of social justice, managed at local rather than state level.

Walras, on the other hand, although sensitive to questions of equity, remained committed to a more centralized, liberal economic model. His main objective was to achieve a general economic equilibrium, in which taxation played a regulatory role without necessarily calling into question the foundations of capitalism. In this sense, Walras is more of a reformer, seeking to improve the functioning of the market rather than radically transform society.

Conclusion

In conclusion, a comparison of Proudhon's and Walras' views on taxation reveals two fundamentally different, yet complementary approaches. Proudhon, with his radical critique of capitalism and the state, proposes a tax reform aimed at correcting social inequalities and redistributing wealth equitably. He did not, however, propose entirely concrete measures. Walras, for his part, although also critical of the tax system of his time, adopted a more moderate, reformist approach, seeking to optimize market efficiency while introducing a new wealth tax to redress the balance. Walras's introduction of economic models was revolutionary in this context, and enabled the period to attempt innovative thinking on this issue.

Although these ideas date back to the 19th century, the issue of individual and corporate taxation is still very much topical. Different political currents are still trying to impose their vision of taxation and, through it, of society more generally.

The contrast between the visions of Proudhon and Walras reminds us that the question of taxation, far from being purely technical, is above all a question of values and societal choices.

Elias KERBAGE, HEConomist

Sources :

Image Proudhon : https://fr.wikipedia.org/wiki/Pierre-Joseph_Proudhon

Image couverture « Qu’est-ce que la propriété » : https://gallica.bnf.fr/ark:/12148/btv1b8626552d

Image caricature impôt : https://www.alamyimages.fr/photo-image-caricature-sur-un-impot-francais-france-1900-113151561.html

Bibliographie :

Jourdain, Edouard. Proudhon. Que sais-je, 2023

Proudhon, Pierre-Joseph. Théorie de l’impôt : question mise au concours par le Conseil d’Etat du Canton de Vaud en 1860. Office de publicité, 1861.

Proudhon, Pierre-Joseph. Qu’est-ce que la propriété ou recherches sur le principe du droit et du gouvernement. Prévot, 1861

Walras, Léon. Théorie critique de l’impôt. Librairie de Guillaumin et Cie, 1861