26.06.2024

Special Report > Léon Walras - HEC - Taxation

"Pioneers Since 1861 or 1911 ? "

The editorial team of the "Pioneers Since 1911" project would like to look back at the situation since the project's launch. At that time, the team was complete, the idea was clear and the attitude was "let’s do it". It was during the decisive stage of visiting the archives that the first questions arose and would shake up our basic assumptions. How could a document dated 1861 be linked to the creation of the HEC Faculty in 1911, 50 years later? Could this single question, which leads to many others, challenge the very identity of the faculty? And yes, let's not forget that each immersion in the past forces us to define or redefine the very identity of the subject, a laborious task that should not be taken lightly. Our thoughts and conclusions in detail:

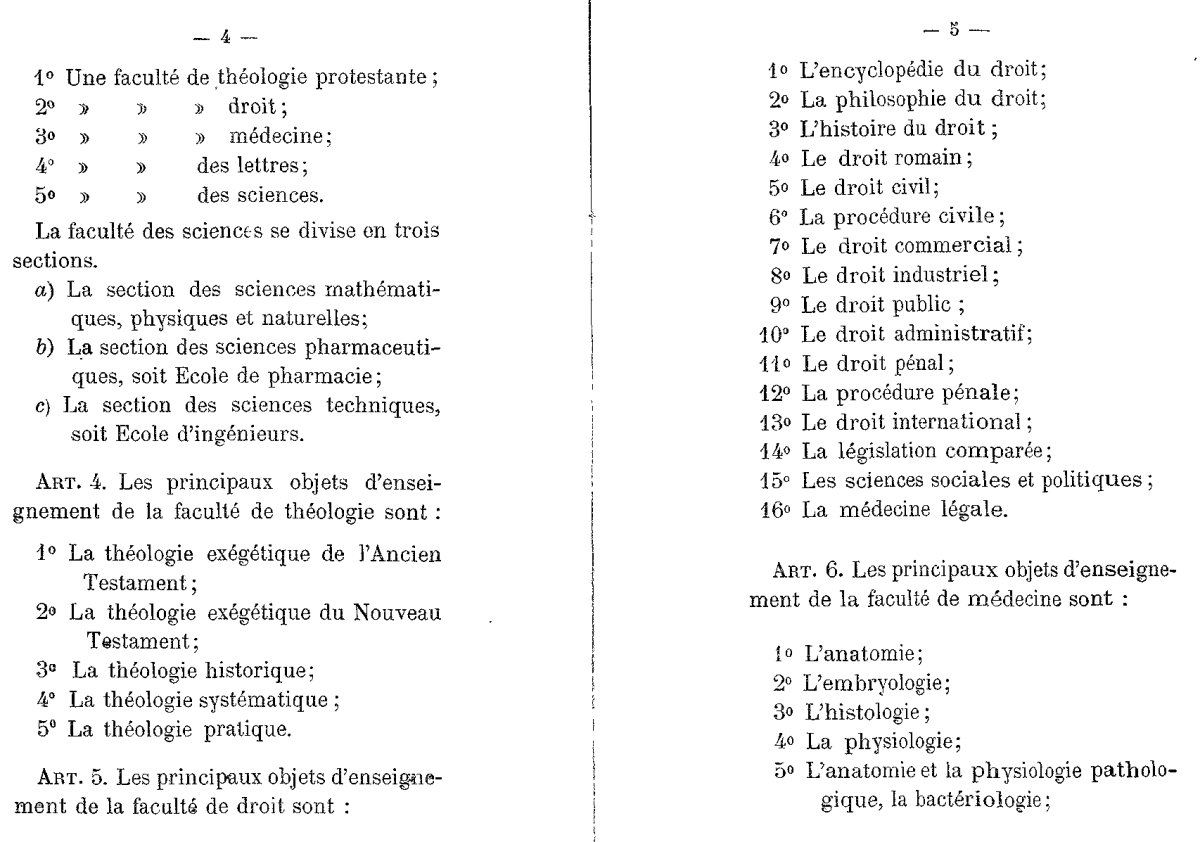

It all started with the discovery of the essay "Théorie Critique de l'Impôt" by Léon Walras, an economist who has been dubbed the "founding father" of the HEC Faculty. At first glance, the document perfectly fulfills the desired criterion. Indeed, it crystallizes the thinking of the time around public taxation and, more specifically, the integration of mathematical concepts to explain various economic phenomena and their consequences. Léon Walras's appointment to the chair of law at the Lausanne Academy's Faculty of Social and Political Sciences (SSP) enabled him to develop this subject and gradually transform it into a real science.

The only drawback is that, in addition to the fact that this document was published in 1861, 50 years before the creation of the HEC Faculty, Professor Walras was never, throughout his career, associated with the creation of the said Faculty. Indeed, his only recognized affiliation was with the SSP Faculty. It was only after his death, and under the aegis of his successor Professor Wilfredo Pareto, that the Faculty was created. But how could we reconcile the fact that Walras was the founding father of a Faculty he never knew in his lifetime? Faced with this observation, we were compelled to delve even deeper into the past and the genesis of the HEC Faculty, in order to better understand the links between these different players in the period of 1860-1911.

To better understand this period, we turned to the Centre Walras-Pareto (CWP), which is under the aegis of the SSP faculty... Yet another detail that doesn't fit with the established narrative. It was during a discussion with Professor Baranzini, Associate Professor at the CWP, that we realized that this tumultuous period in the history of the Académie de Lausanne, later the Université de Lausanne, earned a chapter in "Récits Facultaires", a book that records the genesis and evolution of the Faculty of SSP to the present day.

The ensuing internal discussion leads us to conclude that only in-depth historical research into this period will enable us to better understand the conditions under which the HEC Faculty came to be founded in 1911. A project of this scope would inevitably involve long weeks of archival research and a particularly keen understanding of the subject. Aren't we straying too far from our self-imposed premises, or are we faced with an unprecedented opportunity? An unexplored opportunity to rediscover what has been forgotten about the HEC Faculty, and to give history its rightful place so that it can contribute to the identity of those who have been marked by their learning on these benches.

It is with these questions in mind that we now enter the summer period.

This will give us the opportunity to meet other experts and better define the next steps of the project.

Together with our partners at HEConomist and Innovation Time, we will be striving to bring our readers richer content that will contribute to the future of the HEC Faculty.

And for the past, rediscover the academic effervescence of the late 19th and early 20th centuries in Lausanne, with the emergence of socialist ideas and the heated discussions between protagonists such as Léon Walras and Pierre-Joseph Proudhon on land ownership, taxation, the law of free trade and the general equilibrium model.

To be continued...